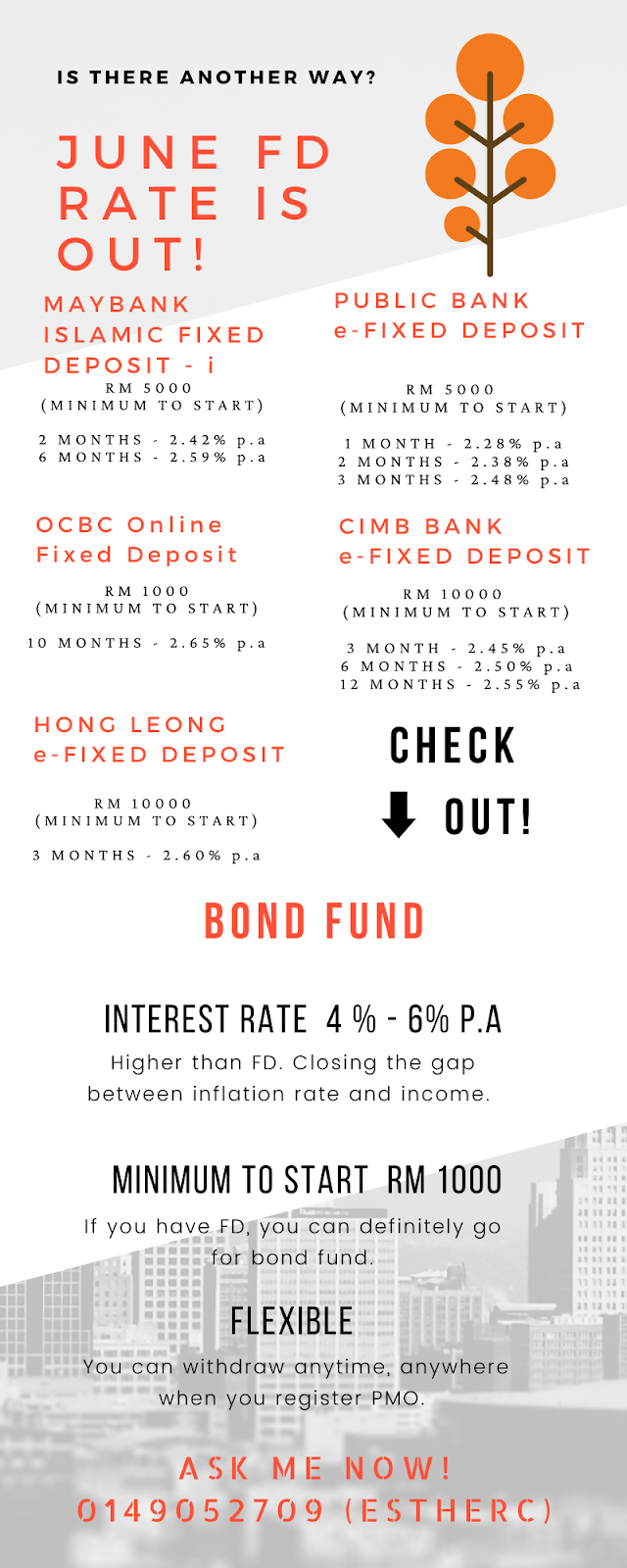

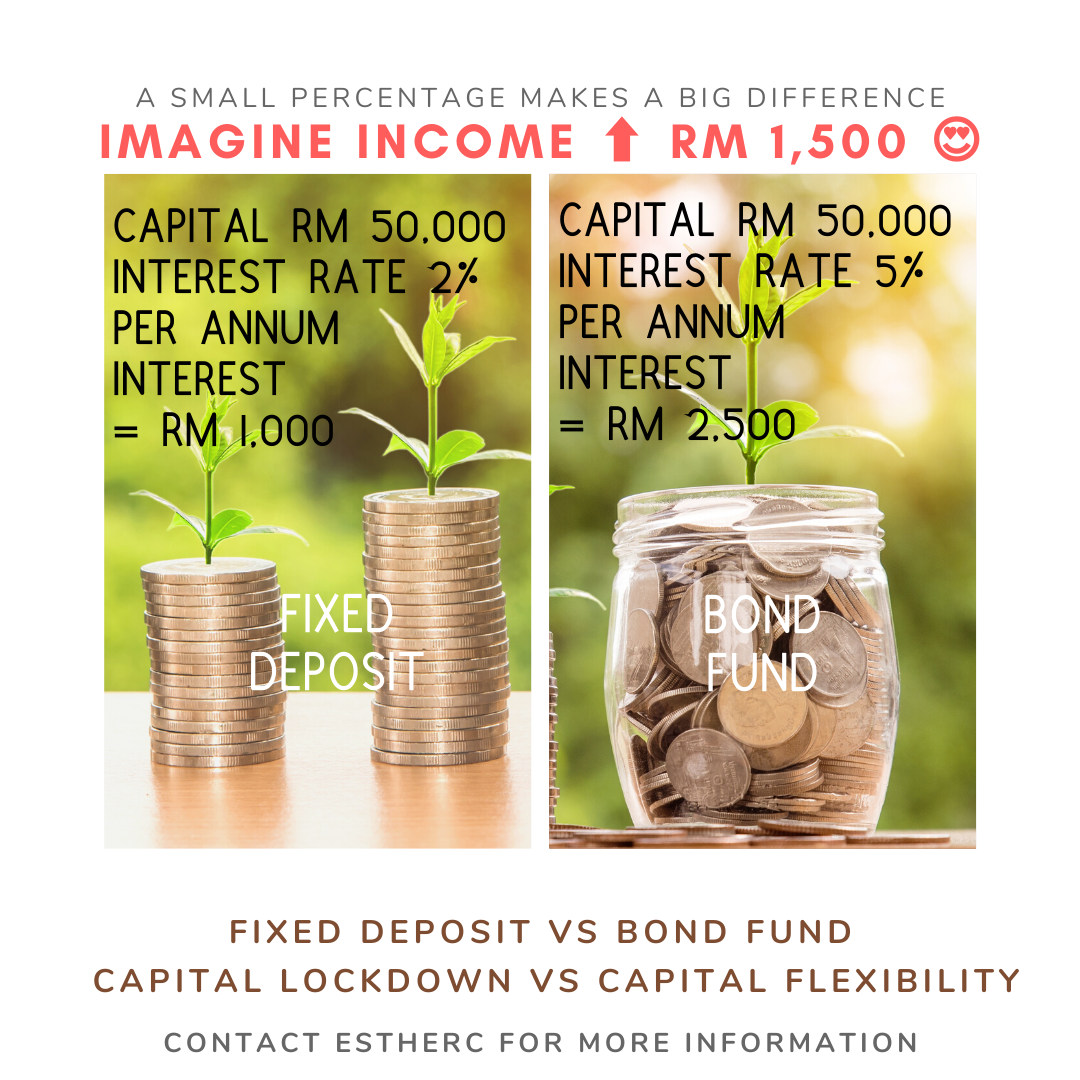

FD rates for June are out! Probably many especially elderly may be concern as well. Have a look at the chart below. These are a few banks that I explored. Whichever age group you may be in, do you want to close the GAP? It can be a GAP or a gap 📊 Fat savings account or FD account isn't a bad thing. It is only bad when you have inflation rate that causes the value to become smaller. Let's say you have RM 10000 in your bank. Fat bank account seems secure you think. But what happens to the VALUE in 20 years? It shrinks to RM 3118 😱 (see the second picture with FV and PV). So if your income RM 3118 seems enough for you now, is it possible for you to get RM 10000 income in 20 years time? INVEST.COMPOUND.SAVE.GROW Everyone has the same time in one day. Are you taking the action to grow your money value? Come talk to me if you want to find out more 👍 Share this if you think this is REALITY. 0149052709 #unittrustconsultant #raceagainstinflation #isyourmoneyworkingashardas